- career.credit

- Posts

- DOWNLOAD: Private Credit Interview Guide

DOWNLOAD: Private Credit Interview Guide

Your Edge in Private Credit Hiring: Plus the biggest news of the week

🎯The Ultimate Private Credit Interview Guide

Today we’re releasing something I’ve wanted to put together for a long time:

The Career.Credit In-Depth Interview Guide

This is the only interview guide dedicated exclusively to Private Credit that I’ve seen in the market. It covers:

10 Behavioural Questions, with example frameworks and sample answers using STAR (Situation, Task, Action, Result).

7 Technical Questions, from EBITDA add-backs red flags to underwriting high-leverage deals, with example responses and frameworks.

🔑 Whether you’re preparing for an Analyst role or stepping up to Principal, this guide gives you structured responses and reasoning that can be adapted directly to your own experience.

|

📊 League Tables — Who’s Leading in Deals?

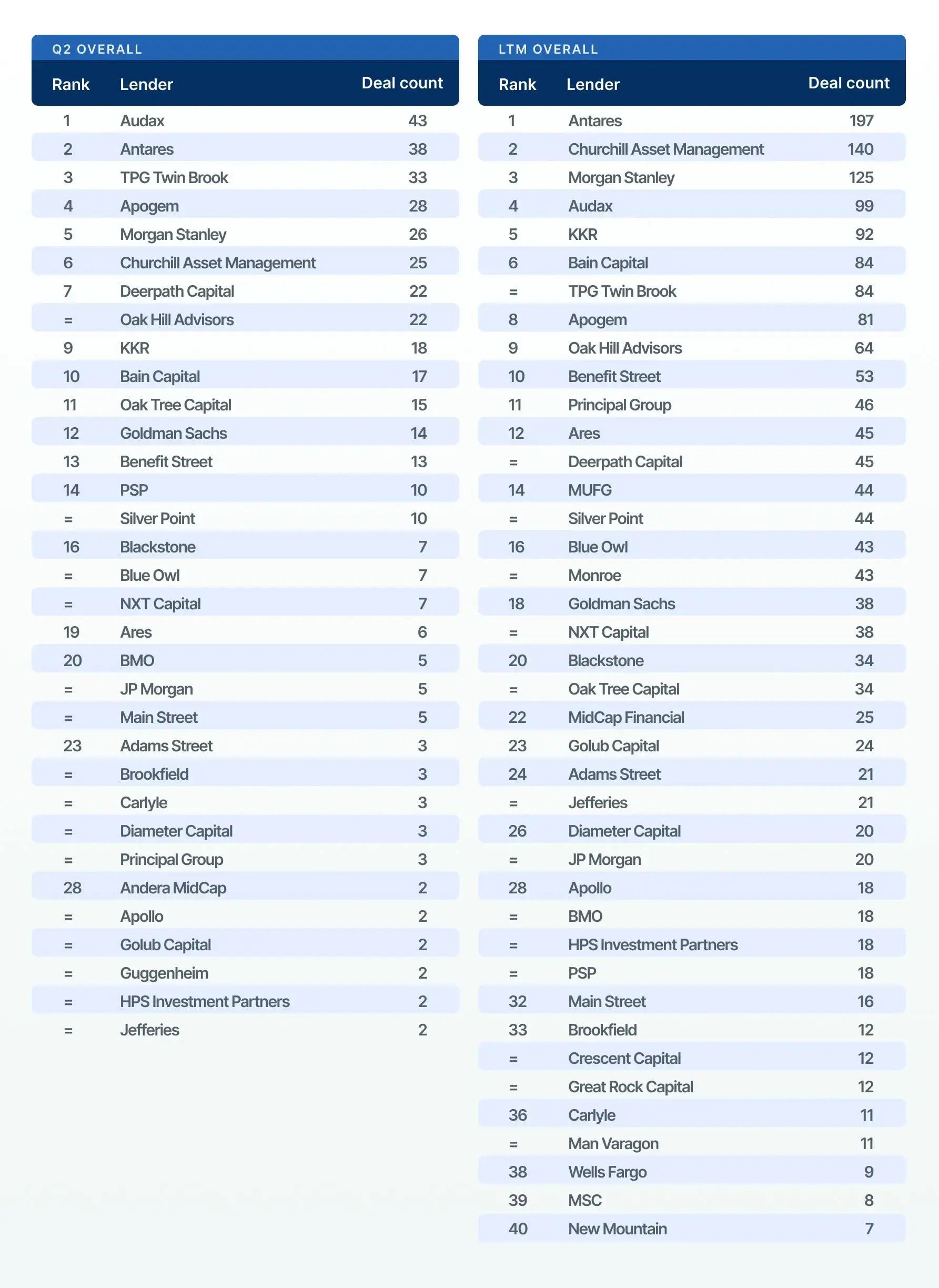

9Fin has just released the Q2 2025 Private Credit League Tables, and the results give us a clear view of which lenders are dominating deal flow:

Q2 Snapshot:

Audax tops the quarter with 43 deals, ahead of Antares (38) and TPG Twin Brook (33).

Morgan Stanley and Apogem round out the top five.

LTM (Last Twelve Months):

Antares leads decisively with 197 deals, followed by Churchill (140) and Morgan Stanley (125).

KKR and Audax complete the top five.

These numbers underscore the growing institutionalization of direct lending and the race to capture mid-market deal share.

Full breakdown here: 9Fin League Tables

🗞 This Week in Private Credit

💰 $2bn Refinancing on the Horizon

Banks and direct lenders are circling a $2 billion refinancing package for Leaf Home, a sign of continued collaboration between banks and private credit funds on large-scale financings.

(Bloomberg)

🏢 PIMCO Outmaneuvers Apollo & KKR

In one of the most closely watched deals of the year, PIMCO secured Meta’s $29bn data center financing, edging out both Apollo and KKR. This reinforces PIMCO’s positioning as a heavyweight in mega-deal private credit.

(Bloomberg)

📦 BC Partners Targets Middle Market

BC Partners has launched a new fund aimed squarely at the US middle market, signaling that competition isn’t just for mega-deals — the mid-market remains hotly contested.

(Bloomberg)

📉 Market Pulse -The Balancing Act

DC Advisory’s H1 2025 report describes the current environment as a balancing act:

LPs demanding liquidity

Borrowers seeking flexibility

Lenders competing aggressively in both the upper and middle market

The result? Creative structuring is back in vogue.

(DC Advisory Report)

💡 Career Tip of the Week

When preparing for private credit interviews, don’t just memorise technical frameworks — practice saying your answers out loud.

It’s not enough to know what to say. You need to deliver answers clearly, confidently, and concisely. Record yourself answering a few technical and behavioural questions, listen back, and refine your delivery.

📥 Free Resource of the Week

👉 Download the Career.Credit In-Depth Interview Guide (Exclusive Launch)

|

Have a great week, dealmakers - see you on Friday.

James